As part of a health insurance application, you need to answer a health questionnaire. Some Spanish health insurance companies ask you to complete this online. Others require you to complete a form and email it back. The questions they ask will vary from company to company but a lot of them will be similar. Here is a list of typical questions that may appear in a questionnaire for Spanish health insurance.

Contents

- What are the typical questions included in a questionnaire for Spanish health insurance?

- What information is necessary?

- Should I leave anything important out?

Health Insurance Spain

Free no obligation quotation for health insurance in Spain. Click the button below and answer a few simple questions to find out how much health insurance will cost you or you and your family.

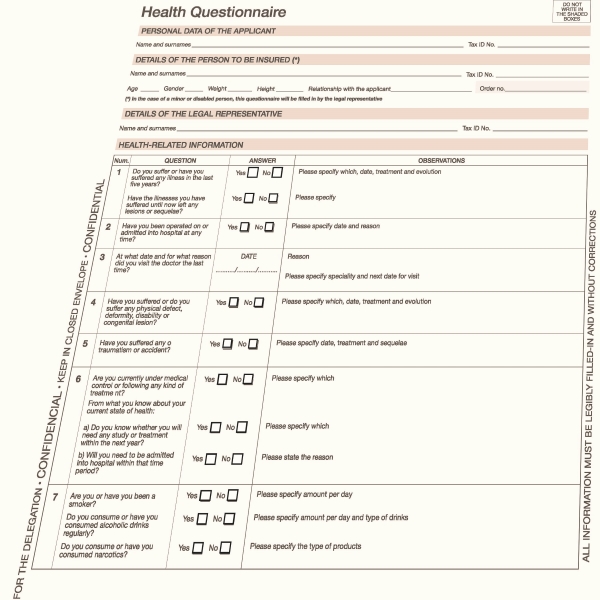

What are the typical questions included in a questionnaire for Spanish health insurance?

- Age of the applicant(s)

- Height

- Weight

- Do you or have you suffered from any illness in the last five years?

- Have you been operated on or admitted to a hospital at any time?

- What date and what was the reason for your last visit to the doctor?

- Have you suffered any traumatism or accident?

- Are you currently under any medical control or following any treatment?

- Do you have any planned visits to the doctor or are you waiting to be admitted to a hospital?

- Are you or have you been a smoker? How many? If you have stopped when did you stop?

- Do you drink alcohol? If so how much do you drink (a day, a week etc…)?

- Do you consume or have you consumed narcotics?

Different companies will ask different questions or similar questions in a distinctive order. This list is not exhaustive.

Be clear and concise and remember the undewriter does not know you

When you complete the questionnaire remember the reader of the questionnaire does not know you. It may seem silly but many people put down, for example, “broke my wrist 2015”. Whilst this may appear fine the company will need to know which wrist. They also want to know if you have fully recovered or whether there are ongoing issues with the wrist.

Another example might be “In 1989 hernia operation”. The insurance underwriter is going to want to know what sort of hernia. Was it a herniated disc in your back or a hernia in your groin? If it was in your groin what side was it? Don’t forget to also include what the treatment was and whether you made a full recovery. A better answer would be, “2015 hernia left side of groin caused by heavy lifting at work. Mesh inserted. Now fully recovered”. Clear and concise is the key. No one has time to read War and Peace but obviously, they need to understand what happened and how you are now.

When you declare the medication that you are taking again be clear and concise. The medical underwriters will want to know the name of the medicine, the dosage, and the reason you are taking it. For example, “Since 01/2022 Ramporil 5mg/day for blood pressure.”

If you make it easier for the underwriter to understand your health then a decision about whether they can provide insurance will be that much quicker. If not the application will be going backwards and forwards causing delays.

Should I leave anything important out?

No, never leave anything important out. There might be a temptation for some people to leave something important out to try and ensure they get cover. However, this is a mistake.

If the question states “Have you been operated on or admitted to a hospital at any time?” then it is referring to your whole life. It is not saying “in the last six years or last ten years” it refers to “at any time”. Take your time and read the questions. They are not usually ambiguous. If you have any doubt then contact us.

As we get older the more likely it is that we have been in hospital. However, a lot of those things will be fairly simple. Broken bones playing a sport, tonsils out, appendix removed. Put them in then no one can say you did not declare them. On their own, these are not likely to cause the underwriters too much concern.

If you do not declare something important and the company becomes aware of it at a later date then they may cancel the treatment you are having and also cancel the policy. You could then find yourself in a foreign country without any medical insurance. This could have huge consequences if you were to need treatment and also if you need health insurance to renew a visa in Spain. It must be more desirable to be aware of an exclusion included in the policy and be able to make contingencies for it than to run the risk of losing all your cover.

In some cases, your medical history will mean you cannot get health coverage. If this is your situation, then clearly it is better to plan your life knowing this than to buy a policy that later will be worthless and leave you in a very difficult position.